Sales Ranking of 23 Major General Contractors | 2021 edition

In this issue of the “State of General Contractors” series, which provides an overview of the status of Japan’s major general contractors based on their business performance, etc., we will introduce the sales rankings (completed constructions/construction count rankings) of the 23 major general contractors based on the sales of each company in the fiscal year ending on March 31, 2021.

Considering the fact that general contractors are generally classified according to their company size, we will introduce the following in detail.

- Sales ranking of the 23 major general contractors

- Sales ranking of super general contractors

- Sales ranking of semi-major general contractors

- Sales ranking of mid-sized general contractors

- Sales comparison by general contractor size

1. Sales ranking of the 23 major general contractors

First, among the 23 major general contractors, Shimizu Corporation was the general contractor with the largest sales at JPY 1.25 trillion. Obayashi Corporation, Kajima Corporation, and Taisei Corporation followed Shimizu Corporation with sales of JPY 1.23 trillion, JPY 1.19 trillion, and JPY 1.14 trillion, respectively. (See figure below)

On the other hand, the general contractor with the lowest sales was the Zenitaka Corporation at JPY 105.6 billion, followed by Tobishima Corporation, Daiho Corporation, and Asanuma Corporation at JPY 107.7 billion, JPY 122.3 billion, and JPY 137.1 billion, respectively, indicating a 10-fold difference from the top general contractors. The average of the 23 companies is JPY 468 billion.

2. Sales ranking of super general contractors

Next, when looking at the five super general contractors, Shimizu Corporation was the super general contractor with the highest sales at JPY 1.25 trillion. This was followed by Obayashi Corporation, Kajima Corporation, Taisei Corporation, and Takenaka Corporation with sales of JPY 1.23 trillion, JPY 1.19 trillion, JPY 1.14 trillion, and JPY 977.1 billion, respectively. (See figure below)

Among the super general contractors, Takenaka Corporation was the only firm whose sales were below JPY 1 trillion. In addition, the difference in sales between Shimizu Corporation and Takenaka Corporation is approximately JPY 280 billion, indicating that there is a relatively large difference among the super general contractors. The average of the five super general contractors is JPY 1.16 trillion, which is above JPY 1 trillion. This amount is between the sales recorded by Kajima Corporation and Taisei Corporation.

3. Sales ranking of semi-major general contractors

Next, a look at the sales of the 10 semi-major general contractors shows that Haseko Corporation is the semi-major general contractor with the highest sales at JPY 563.3 billion. Toda Corporation, Penta-Ocean Construction Co., Ltd., Fujita Corporation, and Maeda Corporation followed with sales of JPY 461.4 billion, JPY 445.1 billion, JPY 379.2 billion, and JPY 366.1 billion, respectively. (See figure below)

On the other hand, the semi-major general contractor with the lowest sales was Tokyu Construction Co., Ltd. with JPY 216.2 billion, which is less than JPY 300 billion. Sumitomo Mitsui Construction Co., Ltd, Nishimatsu Construction Co., Ltd., Hazama Ando Corporation, and Kumagai Gumi followed with sales of JPY 322.2 billion, JPY 328.3 billion, JPY 332.9 billion, and JPY 360.2 billion, respectively. The average sales of the 10 semi-major general contractors is around JPY 377.5 billion, which is between the sales recorded by Fujita Corporation and Maeda Corporation.

4. Sales ranking of mid-sized general contractors

Furthermore, looking at the eight mid-sized general contractors, the general contractor with the largest sales was Okumura Corporation with JPY 215.8 billion. This was followed by Toa Corporation, Tekken Corporation, and Toyo Construction Co., Ltd., with sales of JPY 180.7 billion, JPY 178.2 billion, and JPY 154.8 billion, respectively. (See figure below)

On the other hand, the Zenitaka Corporation was the mid-sized general contractor with lowest sales at JPY 105.6 billion. Tobishima Corporation, Daiho Corporation, and Asanuma Corporation followed with JPY 107.7 billion, JPY 122.3 billion, and JPY 137.1 billion, respectively. The average for the eight mid-sized general contractors was about JPY 150.3 billion, which is an amount between the sales recorded by Toyo Construction Co., Ltd. and Asanuma Corporation.

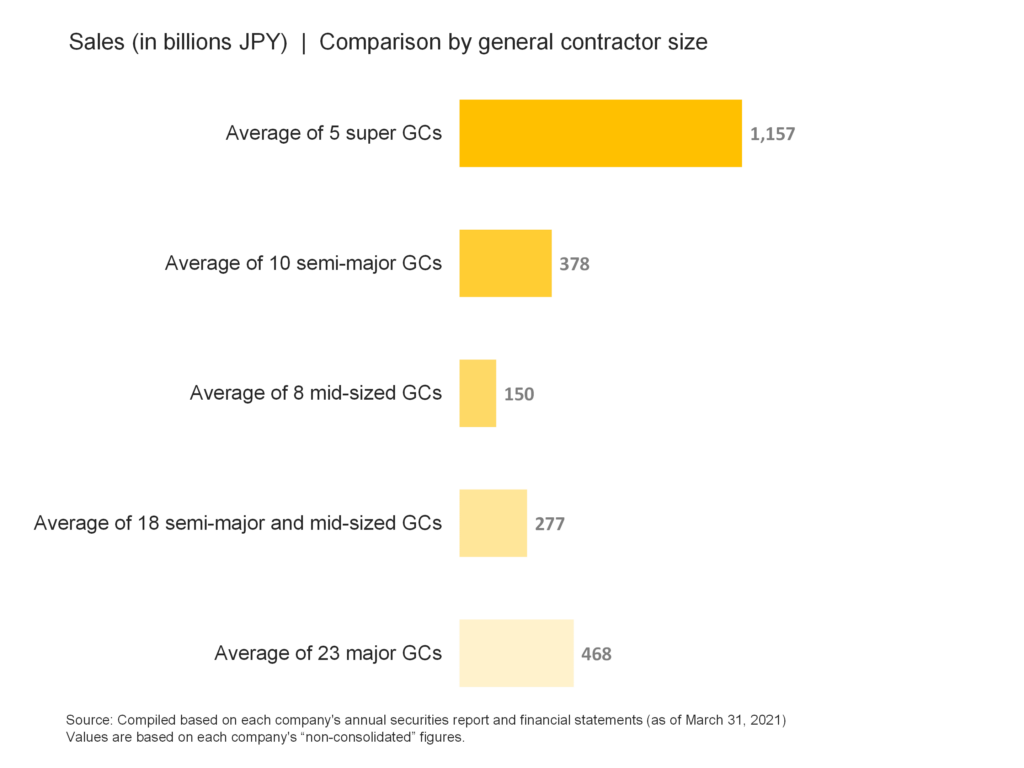

5. Sales comparison by general contractor size

The average sales of the five super general contractors was JPY 1.16 trillion, the average sales of the 10 semi-major general contractors was JPY 377.5 billion, and the average sales of the eight mid-sized general contractors was JPY 150.3 billion. This indicates the scale of super general contractors is about 3.1 times larger than that of semi-major general contractors and about 7.7 times larger than that of mid-sized general contractors in terms of average sales. (See figure below)

From the same perspective, semi-major general contractors are about 2.5 times larger than mid-sized general contractors. The average of 18 semi-major and mid-sized general contractors and 23 major general contractors was JPY 276.5 billion and JPY 468 billion, respectively.

Reference | Data List

Lastly, the following is a list of the 23 major general contractors and the data used for reference.

list of the 23 major general contractors

Data for Sales Ranking of 23 Major General Contractors

| Company | Sales (in billions JPY) | General contractor size |

|---|---|---|

| Shimizu | 1,250.0 | super general contractors |

| Obayashi | 1,230.4 | super general contractors |

| Kajima | 1,189.6 | super general contractors |

| Taisei | 1,144.9 | super general contractors |

| Takenaka | 971.1 | super general contractors |

| Haseko | 563.3 | semi-major general contractors |

| Toda | 461.4 | semi-major general contractors |

| Penta-Ocean Construction | 445.1 | semi-major general contractors |

| Fujita | 379.2 | semi-major general contractors |

| Maeda | 366.1 | semi-major general contractors |

| Kumagai Gumi | 360.2 | semi-major general contractors |

| Hazama Ando | 332.9 | semi-major general contractors |

| Nishimatsu Construction | 328.3 | semi-major general contractors |

| Sumitomo Mitsui Construction | 322.2 | semi-major general contractors |

| Tokyu Construction | 216.2 | semi-major general contractors |

| Okumura | 215.8 | mid-sized general contractors |

| Toa | 180.7 | mid-sized general contractors |

| Tekken | 178.2 | mid-sized general contractors |

| Toyo Construction | 154.8 | mid-sized general contractors |

| Asanuma | 137.1 | mid-sized general contractors |

| Daiho | 122.3 | mid-sized general contractors |

| Tobishima | 107.7 | mid-sized general contractors |

| Zenitaka | 105.6 | mid-sized general contractors |

| Average of 5 super GCs | 1,157.2 | 5 super GCs |

| Average of 10 semi-major GCs | 377.5 | 10 semi-major GCs |

| Average of 8 mid-sized GCs | 150.3 | 8 mid-sized GCs |

| Average of 18 semi-major and mid-sized GCs | 276.5 | 18 semi-major and mid-sized GCs |

| Average of 23 major GCs | 468.0 | 23 major GCs |

Source: Compiled based on each company’s annual securities report and financial statements (as of March 31, 2021)

Values are based on each company’s “non-consolidated” figures.

Comment