How long will steel prices continue to rise?

Steel materials such as reinforcing bars and steel frames are the main materials used in the construction of condominiums, offices, commercial facilities, and logistics facilities. Therefore, when the price of these materials rises, the cost of materials and labor will be affected, resulting in an increase in the level of construction costs. Specifically, when the price of steel soared from 2006 to 2008, the level of construction costs in Japan rose significantly.

In Japan, the prices of typical steel products such as deformed steel bars (rebar) and H-beams (steel frames) have been on an upward trend since 2020 and are still very high and rising as of September 2021. In this report, we will introduce the background of the steel price hike, its impact on construction material prices, construction costs, and future steel price trends.

- Trends in steel prices (from 2006 to the present)

- Why are steel prices soaring?

- Background of raw material price hikes

- Impact of steel price hikes on construction material prices and material and labor costs

- Future trends in steel material prices

1. Trends in steel prices (from 2006 to present)

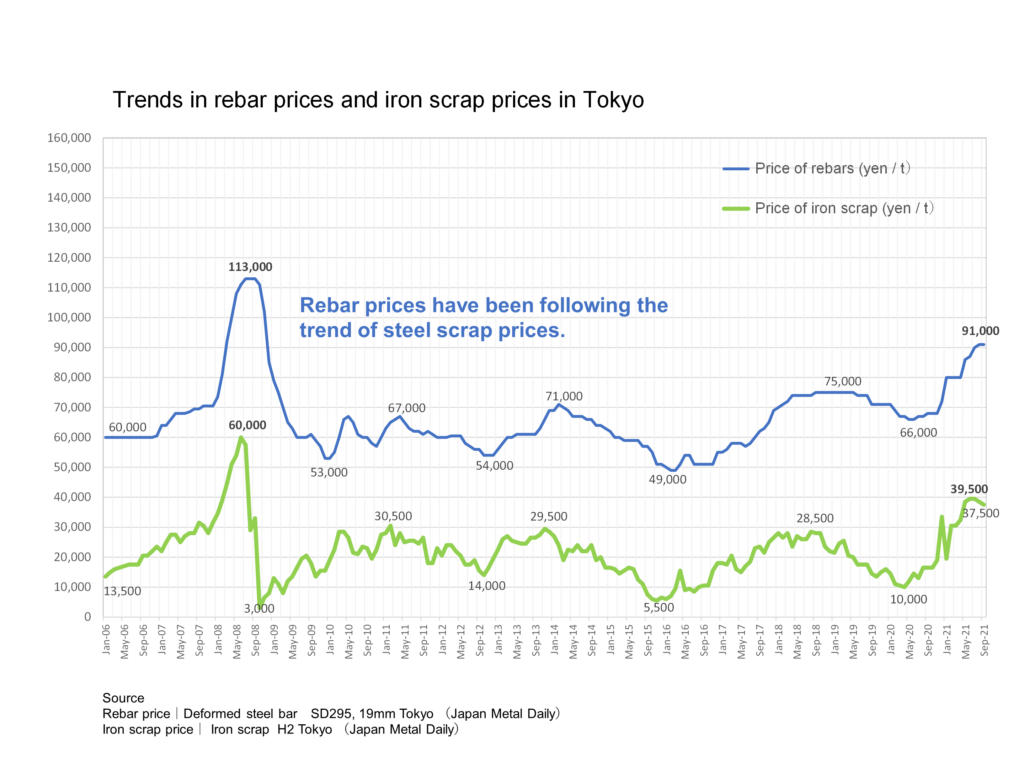

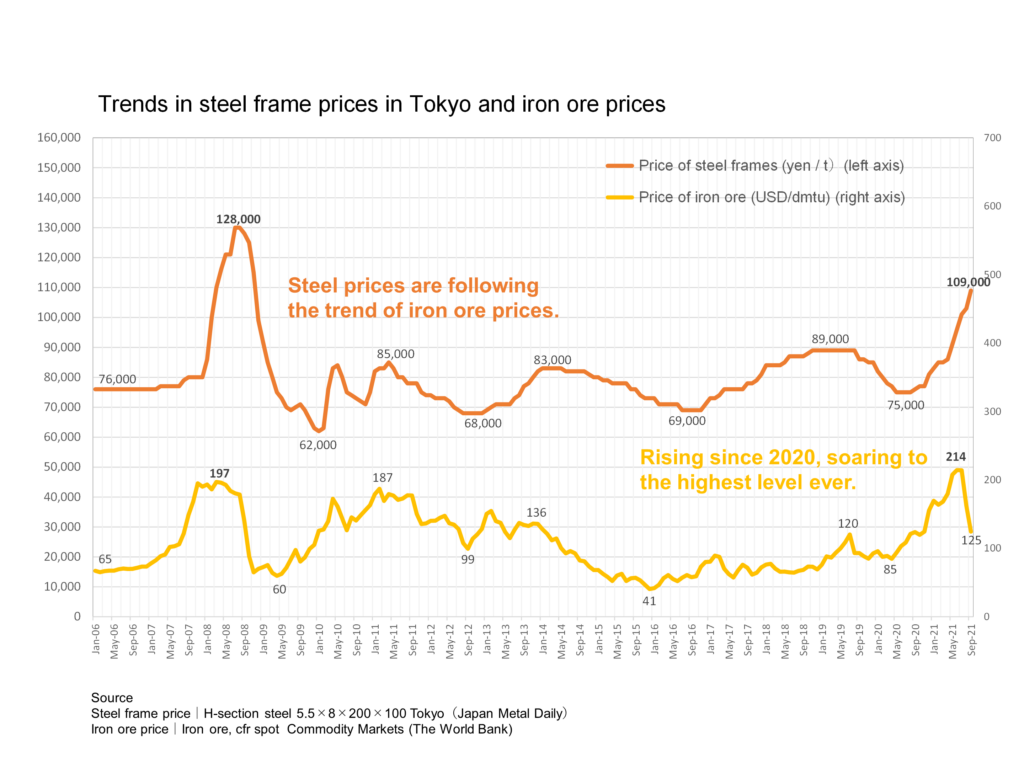

The figure below shows the price trends of rebars and steel frames, the main steel materials, from 2006 to September 2021.

First, the prices of rebars and steel frames increased very significantly until 2008. Specifically, the price of rebars rose more than 83% in 20 months from 60,000 yen/t in November 2006 to 113,000 yen/t in July 2008, and the price of steel frames rose more than 71% in 17 months from 76,000 yen/t in February 2007 to 130,000 yen/t, which were the highest levels ever recorded. By January 2010, the prices of rebars and steel frames had fallen to 53,000 yen/t and 62,000 yen/t, respectively.

Since 2010, rebar prices have generally been in the range of 50,000 yen/t to 75,000 yen/t, and similarly, steel frame prices have been in the range of 62,000 yen/t to 89,000 yen/t. However, we can read that the price of rebars has risen significantly from 66,000 yen/t in June 2020 to 91,000 yen/t in September 2021, and that of steel frames from 75,000 yen/t in August 2020 to 109,000 yen/t in September 2021.

2. Why are steel prices soaring?

The main reason steel prices are soaring is the rise in raw material prices. Steel can be produced in an electric furnace or a blast furnace. In the case of electric furnaces, the raw material is iron scrap, while in the case of blast furnaces, the raw material is iron ore.

Since rebar is produced in an electric furnace, the raw material for rebar is iron scrap. Looking at the transition of rebar prices and iron scrap prices, we can see that rebar prices fluctuate in a manner that lags behind iron scrap prices by three months to one year, and that they are affected by raw material prices. (See figure below)

Since steel frames are mainly produced in blast furnaces, the raw material for steel frames is iron ore. Looking at the trend of steel frame prices and iron ore prices, we can see that steel frame price fluctuates after a time lag of about six months to a year from the change in iron ore price, which is affected by raw material prices. (See figure below)

As shown in the figure below, the prices of steel bars and steel frames are greatly affected by the soaring prices of iron scrap and iron ore, which are raw materials, and have been rising with a time lag.

3. Background of raw material price hikes

Raw material prices fluctuate, influenced by the state of steel demand overseas. For example, Japan is unable to obtain iron ore domestically, so it relies on imports, and when the supply-demand balance is upset, such as by a surge in demand outside Japan, transaction prices rise.

In addition, although iron scrap can be secured in abundance in Japan, it is also exported overseas, so when overseas trading prices rise, overseas exports, which can be sold at higher prices than domestic distribution, are chosen instead, resulting in higher domestic prices.

In this way, the prices of iron ore and steel scrap are both affected by the supply and demand situation of steel products overseas.

In fact, when the price of raw materials soared from 2006 to 2008, economic growth in China, including real estate development, led to an extremely large increase in global crude steel production for four consecutive years from 2004 to 2007, growing by more than 8% compared to the previous year.

The global crude steel production in 2020 was flat at about 0.2% growth compared to the previous year, partly due to the impact of the new coronavirus. However, with the resumption of economic activity in many countries, crude steel production in the period from January to August 2021 is expected to surge by 10.6% year-on-year, which is likely to have an impact on the current surge in raw material prices.

4. Impact of steel price hikes on construction material prices and material and labor costs

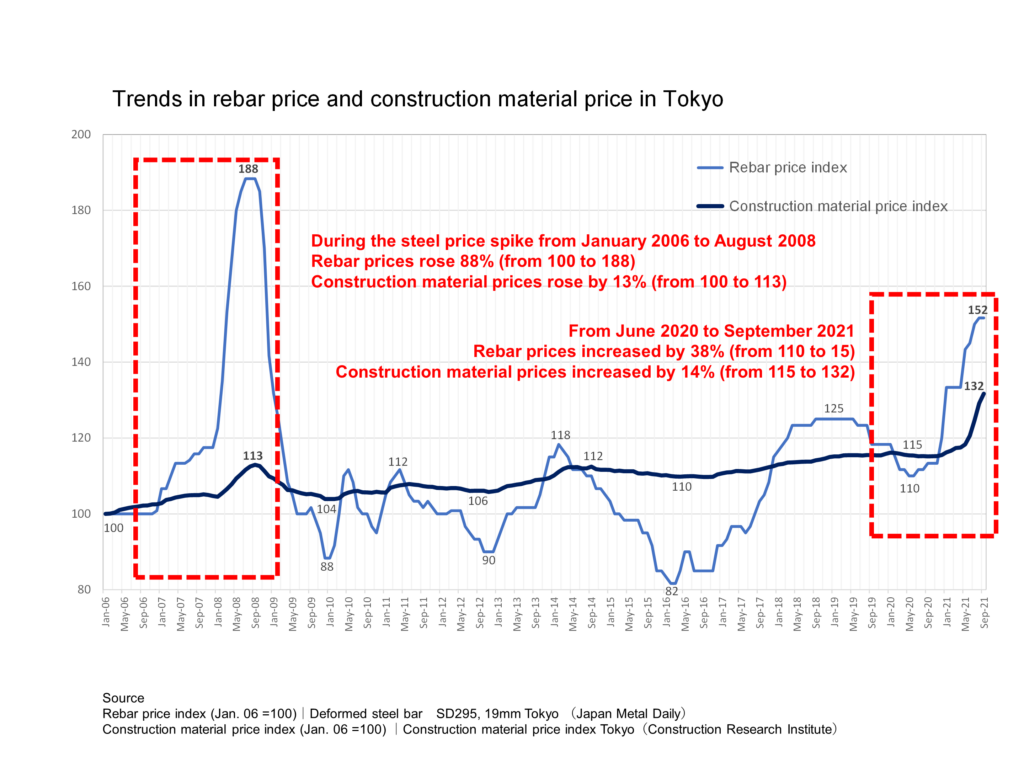

In this section, we will examine the impact of steel price hikes on construction material prices and material and labor costs.

First, looking at the impact on prices of construction materials, we can see that when rebar prices rose 88% during the period of steel price hikes from January 2006 to August 2008, prices of construction materials rose 13%. It can also be read that from June 2020 to September 2021, when rebar prices rose by 38%, construction material prices rose by 14%. (See figure below)

Comparing these two cases, we can see that even though the rebar price increase rate of the former is 88%, much higher than the latter’s 38%, the construction material price increase rate of the latter is 14%, higher than the former’s 13%. This can be attributed to the fact that while prices of other construction materials hardly rose during the period of high steel prices from 2006 to 2008, prices of other materials have also risen in recent years, such as the so-called “wood shock” that caused lumber prices to soar.

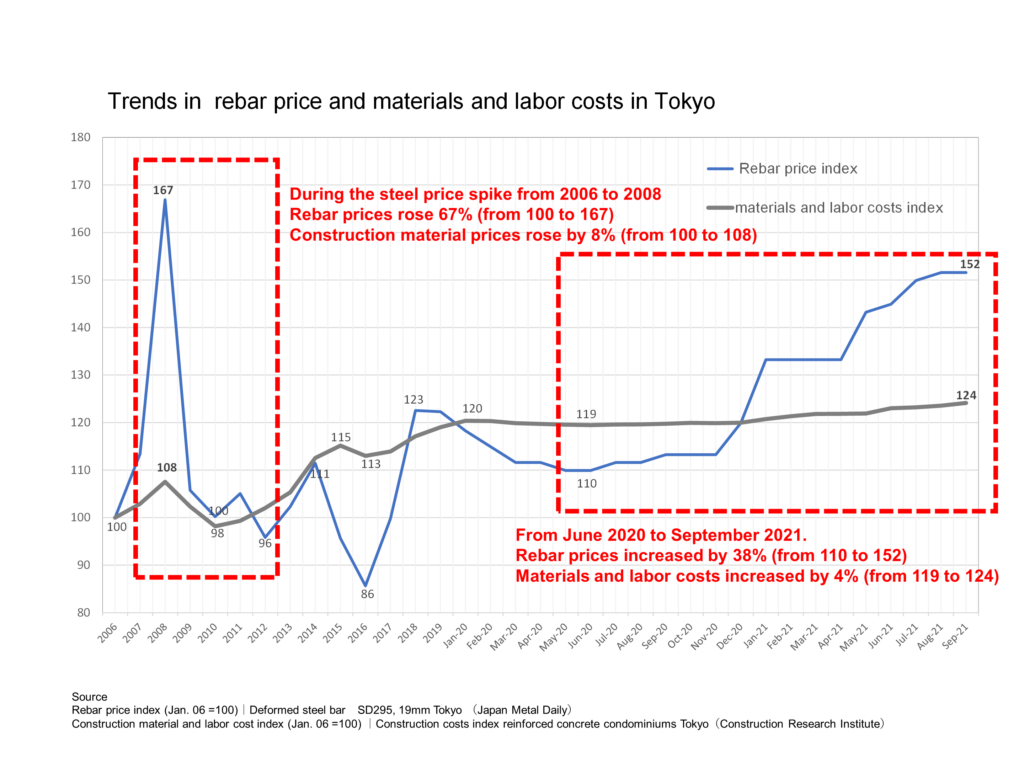

Next, looking at the figure below for the impact on materials and labor costs, it can be read that while rebar prices rose 67% from 2006 to 2008, materials and labor costs rose 8%. It can also be seen that from June 2020 to September 2021, the price of rebar has increased by 38% while the cost of materials and labor has increased by 4%.

Thus, in the case of steel price hikes, construction material prices have risen by more than 10%, and material and labor costs have risen by about 4% to 8%, indicating that steel price hikes have an impact on construction material prices and material and labor costs.

5. Future trends in steel material prices

Lastly, we will discuss the future trend of steel prices in Japan. As mentioned above, the main reason for the current surge in steel prices is the rise in raw material prices due to the rapid increase in global demand for steel.

Therefore, there are two major cases: one is that steel prices will rise further as global demand for steel increases and raw material prices continue to rise, and the other is that steel prices will fall as demand for steel decreases and raw material prices fall.

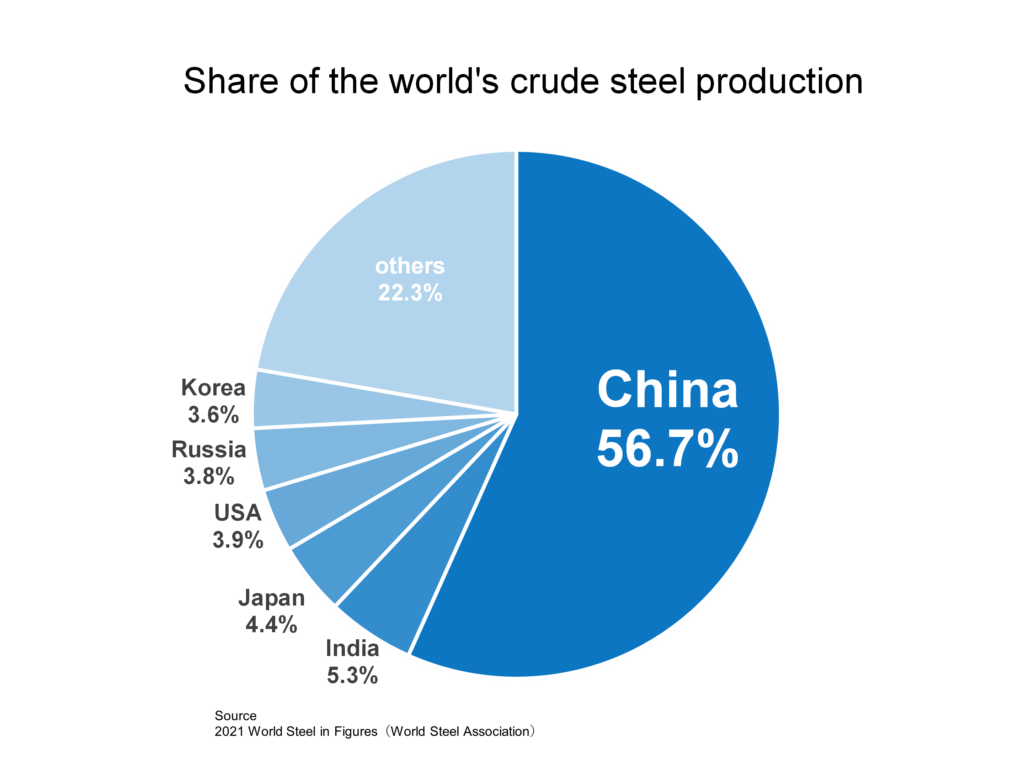

The future global demand for steel products will be affected by the demand trend for steel products in China. This is because, as shown in the figure below, China accounts for about 57% of the world’s crude steel production.

As of October 2021, the Chinese economy is expected to slow down in the short term due to management problems concerning real estate companies that includes major Chinese companies, and the restriction and suspension of operations at Chinese factories due to power shortages. In addition to this, the Chinese government has asked the steel industry in the capital city of Beijing and surrounding areas to reduce crude steel production for four months from November 15, 2020 to March 15, 2022 in order to enhance CO2 emission reduction and prevent air pollution for the Beijing Winter Olympics scheduled to be held in February 2022.

If the power shortage problem persists and the Chinese economy slows down, and if the reduction in crude steel production is also implemented as planned by the Chinese government, there is a high possibility that raw material prices will start to fall, and in that case, steel prices in Japan will fall after a time lag of three months to one year.

On the other hand, if economic activity accelerates in India, Japan, the U.S., and other countries around the world excluding China, and if the increase in global demand for steel exceeds the decrease in crude steel production in China, raw material prices are likely to rise further from the current level, in which case domestic steel prices will rise further. In this case, domestic steel prices will rise further.

As mentioned above, in this report, we introduced various aspects of the current steel price hike in Japan, including the background of the steel price hike, the impact on construction material prices, material and labor costs, and future steel price trends.

Comment