Material price hikes are becoming more prominent amid recovery in construction demand

As of 2021, the construction market in Japan is gradually recovering as economic activity, which had been stagnant due to COVID-19, gradually resumes. By September, construction demand in Japan had recovered by 4.4% year-on-year as mentioned in the report “Construction Demand in Japan Recovering from COVID Shock.”

On the other hand, the Japanese construction market is facing unprecedented conditions due to the double shock consisting of the wood shock and iron shock, in which prices of lumber and steel prices soar, respectively.

While lumber is widely used for housing, which accounts for about 60% of domestic construction demand, steel materials such as rebar and steel frames are major construction materials used in the construction of condominiums, offices, commercial facilities, and logistics facilities.

When the prices of major construction materials such as lumber and steel soar, the cost of materials increases, which in turn increases the cost of materials and labor and affects construction costs.

In this report, we will discuss how much construction material prices, material and labor costs, and construction costs have actually risen due to soaring lumber and steel prices, and what the future trends in construction costs will be.

- Trends in lumber and steel price levels (from 2020 to the present)

- How much are construction material pries rising?

- How much are construction material and labor costs rising?

- How much are construction costs rising?

- Future construction price trends.

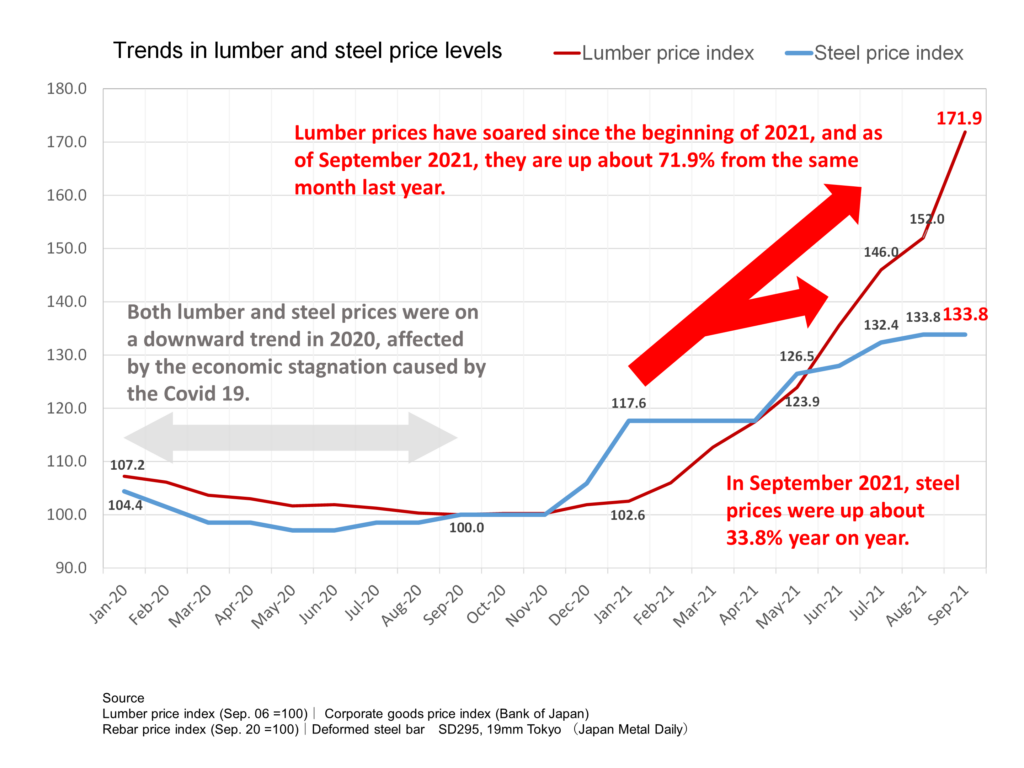

1. Trends in lumber and steel price levels (from 2020 to the present)

The figure below shows the level of lumber and steel prices from January 2020 to September 2021. The following chart shows the level of lumber and steel prices from January 2020 to September 2021. Both lumber and steel prices had been on a downward trend in 2020 due to the economic stagnation caused by COVID-19, but have increased significantly since the beginning of 2021. Specifically, from September 2021, lumber prices increased by about 72% and steel prices by about 34%.

Thus, we can see that the current construction market is experiencing a double shock consisting of the wood shock and iron shock, in which lumber prices and steel prices soar, respectively.

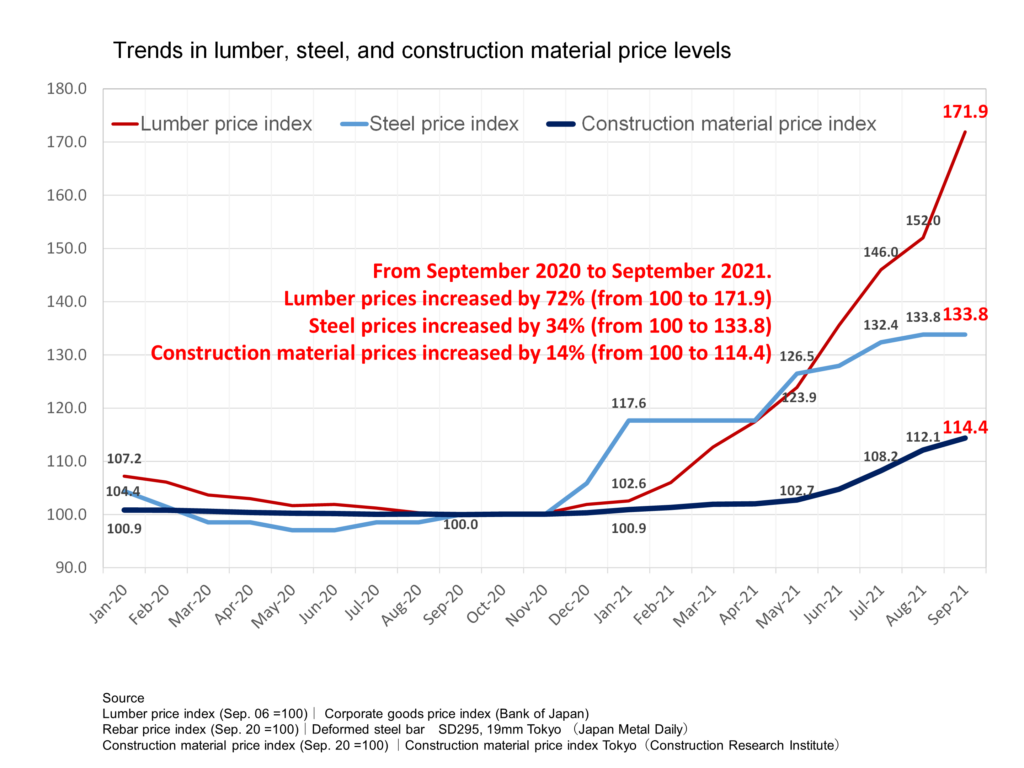

2. How much are construction material pries rising?

As a result of the simultaneous occurrence of the wood shock and the iron shock, the level of prices of construction materials has risen by 14% from September 2020 to September 2021, as a result of a 72% increase in lumber prices and a 34% increase in steel prices. As a result, construction material prices have increased by 14%. (See figure below)

In addition, while lumber prices began to rise in 2021 and steel prices began to rise at the end of 2020, prices for construction materials began to rise around February 2021, indicating that prices for construction materials rose with a time lag of about three months after lumber and steel prices rose.

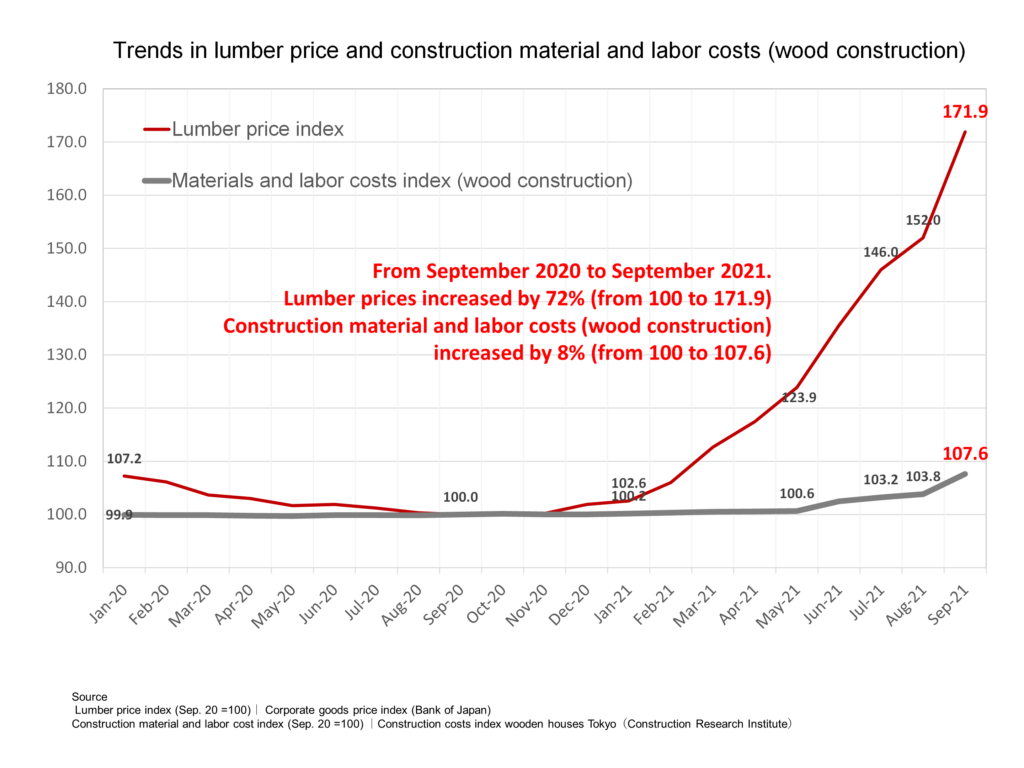

3. How much are construction material and labor costs rising?

Next, we will examine the extent to which the level of materials and labor costs have risen under the current double shock situation. First, regarding lumber prices and the cost of materials and labor for wood construction, we see that from September 2021 to September 2021, lumber prices have risen 72%, resulting in an increase in the cost of materials and labor for wood construction of about 8%. In addition, while lumber prices began to rise in 2021, lumber material and labor costs began to rise in June 2021, indicating that lumber material and labor costs rise with a time lag of about six months after wood prices rise. (See figure below)

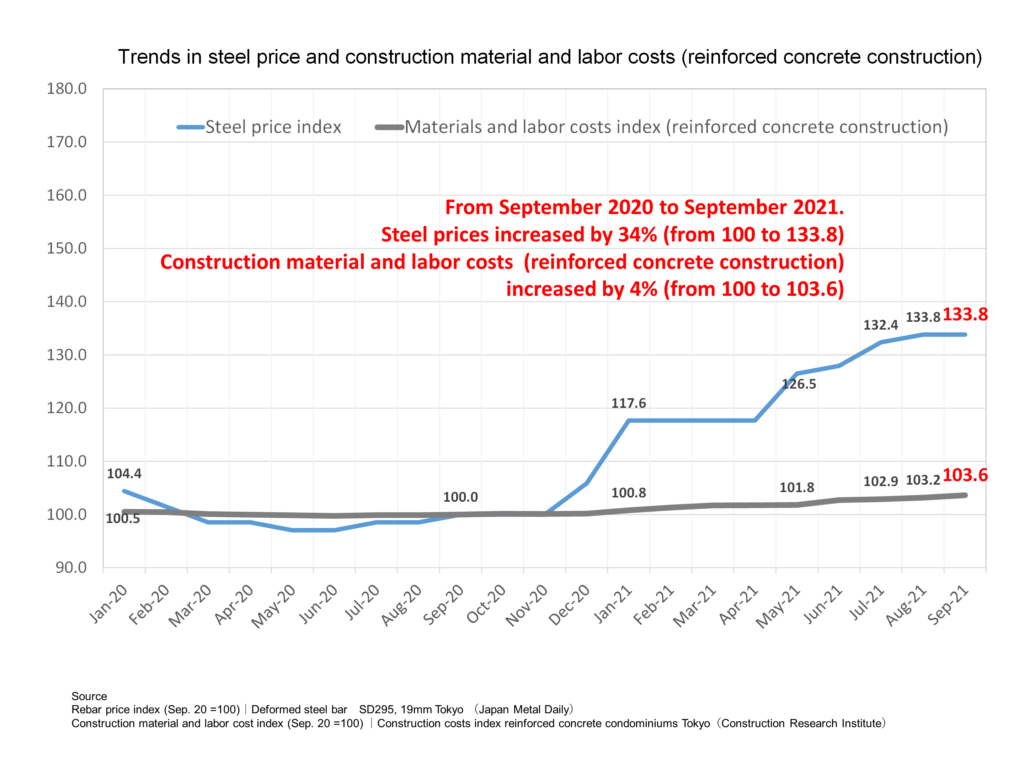

Next, let’s look at the price of steel and the cost of materials and labor for reinforced concrete construction: from September 2020 to September 2021, the price of steel has increased by 34%, while the cost of materials and labor for reinforced concrete construction has increased by about 4%. In addition, while the price of steel began to rise from the end of 2020, the cost of materials and labor for reinforced concrete construction began to rise in February 2021, indicating that the cost of materials and labor for reinforced concrete construction rose with a time lag of about three months after the price of steel rose. (See figure below)

Thus, in a double shock situation where both lumber and steel prices are rising, the cost of materials and labor for wood construction has risen by about 8%, while the cost of reinforced concrete construction has risen by about 4%. In addition, we find that material and labor costs begin to rise after lumber and steel prices begin to rise, with a delay of about six months in the case of wood construction and about three months in the case of reinforced concrete construction.

4. How much are construction costs rising?

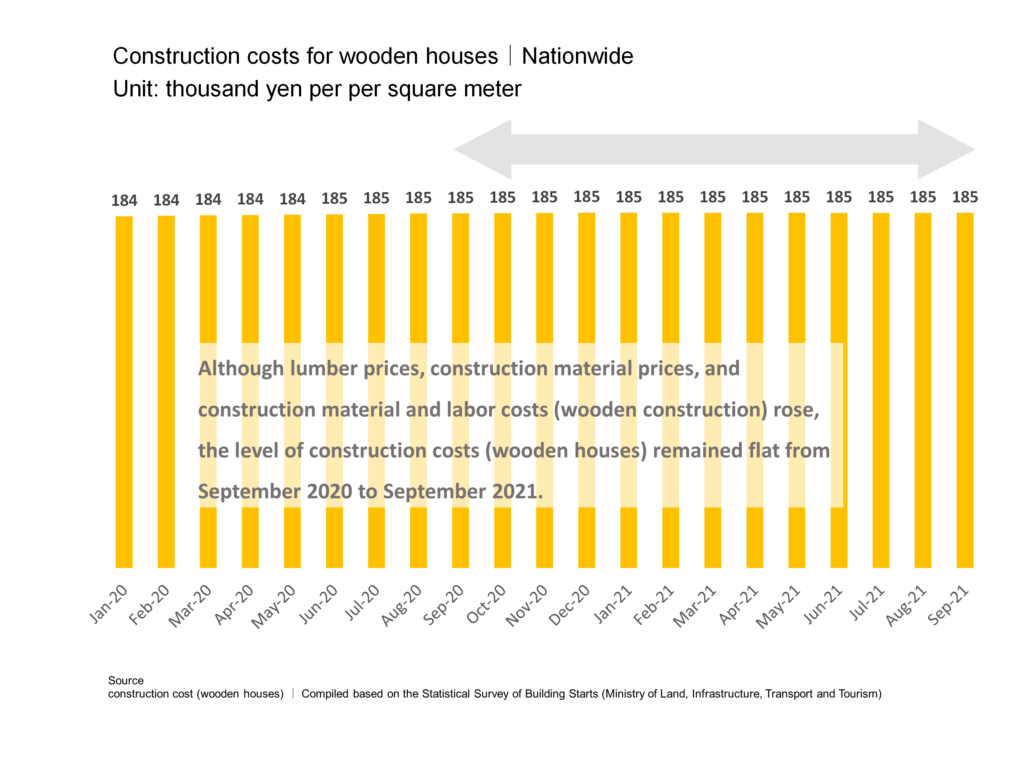

We will now look at the extent to which construction costs for both wood and reinforced concrete structures actually rose during the wood shock and iron shock. First, if we look at the level of construction costs for wooden houses, using the example of single-family wooden houses for owner-occupancy, we can see that they have remained flat at the level of 185,000 yen per square meter from September 2020 to September 2021. (See figure below)

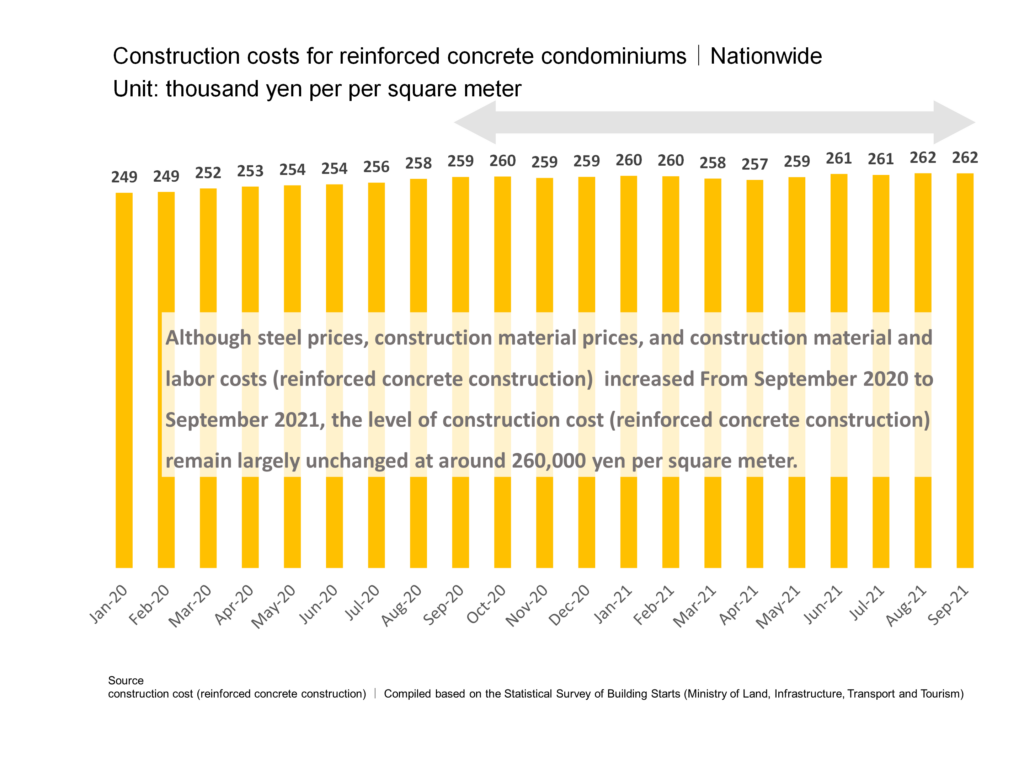

Looking at the level of construction costs for reinforced concrete condominiums as an example, there was a slight increase of about 0.9% from 259,000 yen/square meter in September 2020 to 262,000 yen/square meter in September 2021. However, for the past year, the level has remained generally unchanged at around 260,000 yen per square meter. (See figure below)

As can be seen in the figure below, the level of construction costs based on the Statistical Survey of Building Starts (Ministry of Land, Infrastructure, Transport and Tourism) for wooden and reinforced concrete structures has generally remained unchanged, despite the fact that the prices of construction materials and the costs of materials and labor have risen while the prices of lumber and steel have soared.

5. Future construction price trends.

Finally, we will discuss future trends in construction costs. As mentioned above, the level of construction costs has generally remained unchanged as of September 2021, despite the increase in the prices of construction materials and the level of materials and labor costs.

In general, construction costs are calculated by adding the cost of materials and labor to the cost of construction companies (administrative costs, profits, etc.). Therefore, it would seem that if the level of materials and labor costs rise, construction costs would also rise, but they have generally remained flat.

Why is this?

This is because construction companies are absorbing the increase in material and labor costs caused by the soaring prices of lumber and steel by cutting their own expenses (profits). In fact, if we look at the non-consolidated operating income of listed construction companies for the second quarter of the fiscal year ending March 2022 (April to September 2021), we can see that most of them have seen a decrease in profits.

Taking the operating income of the four major listed companies as an example, Obayashi Corporation saw a decrease of 89% from 41.0 billion yen in the previous fiscal year to 4.4 billion yen this fiscal year, Taisei Corporation saw a decrease of 50% from 40.3 billion yen in the previous fiscal year to 20.3 billion yen this fiscal year, Kajima Corporation saw a decrease of 44% from 61.1 billion yen in the previous fiscal year to 34.3 billion yen this fiscal year, and Shimizu Corporation saw a decrease of 85% from 42.2 billion yen in the previous fiscal year to 6.2 billion yen this fiscal year.

As a result, the level of construction costs has generally remained flat, but there is a limit to how much of the increase in costs can be absorbed by the companies themselves, so it is expected that the increase in costs will be passed on to construction costs and the level of construction costs will gradually rise.

So when exactly will construction costs start to rise?

Let’s look at an example of a case where steel prices soared from 2006 to 2008, and the level of construction costs rose significantly. While steel prices peaked in 2008 and fell in 2009, the level of construction costs peaked in 2009 and began to fall in 2010, suggesting a lag of one year.

Based on this case, we believe that after a time lag of about one year from when lumber and steel prices began to rise, there will be a full-fledged move to pass on the increased costs to construction costs, and the level of construction costs will begin to rise from the end of 2021 or the beginning of 2022.

Even if the rise in lumber and steel prices pauses and peaks in 2021 and then declines in 2022, there is a strong possibility that the level of construction costs will continue to rise for a certain period of time before declining, rather than falling immediately.

As described above, in this report, we examined the extent to which prices of construction materials, materials and labor costs, and construction costs have risen up to September 2021 in a double-shock construction market, in which the price of lumber is rising and the price of steel is rising. In addition to understanding how much construction material prices, material and labor costs, and construction costs have risen up to September 2021, this report also introduced future trends in construction costs.

Comment